Spotify, YouTube, Netflix announce financial success and growth results

These reports are very material to where the world currently is.

In thick of coronavirus lockdown measures across the world, leading streaming platforms, YouTube, Spotify and Netflix have released their financial reports for Q1 2020 which ended on March 31, 2020.

At the start of lockdown measures across the world, streaming on audio platforms took a hit while streams on video platforms increased in leaps and bounds. While this does not necessarily affect a Nigeria where is streaming demography is under 15% of the population, Apple Music, Netflix and YouTube must have seen increased Nigerian traffic.

YouTube

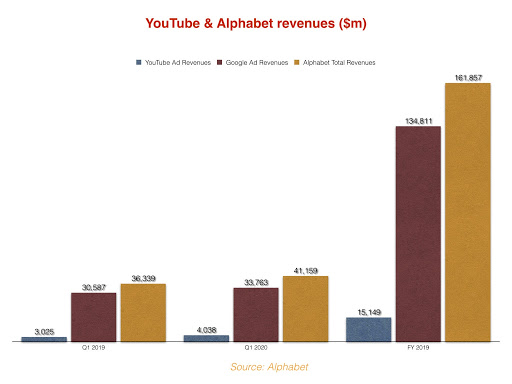

According to Music Business Worldwide, in the quarter ending March 31, 2020, YouTube’s advertising revenue hit $4.038bn which equates $44.9m every day, or $32.0k every minute. YouTube is a subsidiary of Google and Google of is a subsidiary of Alphabet.

What those numbers mean is that in Q1 2019, Google’s total advertising revenues (including YouTube) was $30.587bn. In Q1 2020, Google’s total advertising revenues (including YouTube) is $33.763bn - up by more than $3bn.

However, according to Music Business Worldwide, this hid a decline in viewership and ad revenue in March. What this means is simple; YouTube was on course for a healthy financial quarter before COVID-19 lockdown hit.

What does this mean for music?

According to Pex, a Los Angeles-based company, in 2018 and 2019, YouTube’s music content amounts to 5% of its content based. Gaming has the highest with 37%, personal blogs with 21%, Entertainment with 10% and other types of content with 19%. Nonetheless, despite the low numbers in content base, music accounts for 22% of YouTube’s streams.

YouTube pays creators and rightsholders 55% of its $15 billion ad revenue which equates about $8 billion. Interestingly, music claimed 22% of that $8 billion in 2019.

Spotify

As noted earlier, streaming on audio platforms took an 11% hit in March, yet by the end of March, Spotify was on track with;

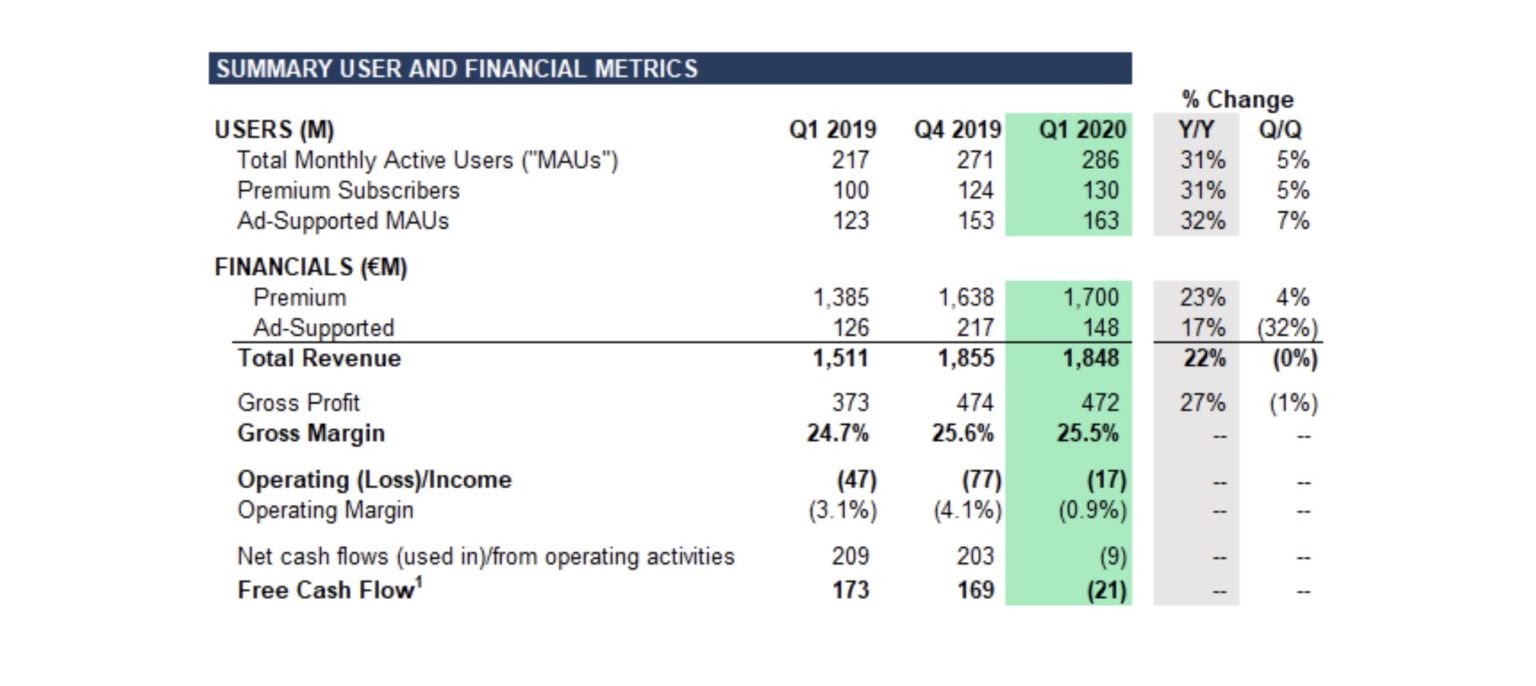

- 6m new subscribers.

- Increase to 130m subscribers - projection was 131m.

- Revenue hit €1.85bn - premium revenue grew 23% YoY to €1.70bn. That equates a 22% and 23% year-on-year increase respectively.

According to Music Business Worldwide, Spotify’s total monthly active users (MAUs), including subscribers plus free/ad-supported users, hit 286m in Q1 2020, up by 15m quarter-on-quarter and by 69m (+31%) year-on-year.

Equally, Spotify’s revenues in Q1 2020 was €148m - which equates a growth of 17% YoY at the company. However, that hides a heavy decline quarter-on-quarter, down by 32% on the €217m posted in Q4 2019.

With the lockdown, Spotify now expects to end 2020 with between 328m and 348m Monthly Active Users - 143m to 153m Premium subscribers while.annual revenue is projected to be between €7.65bn and €8.05bn. At the start of the year, projections were between €8.08bn and €8.48bn.

Netflix

Remember, in March 2020 as the lockdown started to intensify, video-based streaming platforms had an increase in usage and subscriber base. In Q1 2020, Netflix reported a 15.8 million increase in its subscriber base.

That is two times the company’s projection at the start of 2020 - which was around 7 million new subscribers - and almost 2x the Wall Street consensus of a little less than 8 million. That said, that massive increase has not impacted revenue which stood at $5.77 billion in Q1 2020.

The projection was $5.76 billion at the start of 2020. The revenue wasn’t significantly affected because 85% of the 15.8 million new subscribers were in international markets. For that reason, the revenue was adversely affected by a stronger dollar. You might remember that Netflix launched a Nigerian division earlier in the year.

The projection is that Netflix won’t see upward spikes like this in the remaining three quarters of 2020.

What does this all mean?

It means that COVID-19 lockdown and restriction of movement is a good thing for streaming platforms who might get more subscribers around this time due to the consequences of boredom and restriction of movement. However, for a company like Netflix, it’s spike was too high for it to be replicated so that might dampen expectations in other quarters.

For the stock market, it’s such a healthy time to invest in certain streaming stocks - but maybe not in Nigeria.

According to Midia Research, a major challenge with a continued lockdown is the possibility of streaming services starting to fight churn rates as consumers trim their spending. Some bold thinking will need to be done around retention tactics, such as a three-month payment holiday for subscribers that try to cancel. Whether labels would be willing to fund such promotions is another issue entirely,

While streaming platforms will have increased consumers, illegal platforms will also have increased consumers and users. For streaming platforms, they could also have bandwidth problems as users overload their databases and systems.

Post a Comment